When it comes to trust planning in NH, one of the most common questions we hear is: “What’s the difference between a revocable and an irrevocable trust, and how do they affect probate?” Understanding these two types of trusts is key to crafting a solid estate plan—especially if your goal is to simplify or avoid the probate administration process altogether.

In this article, we’ll break down the key differences between revocable and irrevocable trusts, how each impacts probate, and which might be the right choice for your situation.

What Is a Trust, and Why Does It Matter?

A trust is a legal arrangement that allows a third party, known as a trustee, to manage assets on behalf of beneficiaries according to your wishes. Trusts are essential tools in estate planning because they offer control, flexibility, and—perhaps most importantly—can help avoid probate.

Why Should You Try to Avoid Probate?

Probate is the court-supervised process of distributing a deceased person’s estate. While it ensures legal oversight, it can also be time-consuming, public, and costly. Many people use trusts to streamline estate settlement and reduce the burden on their loved ones.

Revocable Trusts: Flexible But Still Exposed to Probate Risks

A revocable trust, sometimes called a living trust, can be changed, updated, or revoked by the grantor (you) at any time during your lifetime.

Pros:

- You retain full control of the trust and its assets.

- Easy to modify as your life circumstances change.

- Helps your estate avoid probate if properly funded.

Cons:

- Assets are still considered part of your taxable estate.

- Offers little protection from creditors or lawsuits.

- Doesn’t protect assets from nursing home costs (Medicaid spend-down).

Revocable Trusts Impact on Probate in NH:

If all assets are placed in the revocable trust before death, the estate can bypass probate entirely. However, if assets are left outside the trust, those will still go through probate administration in New Hampshire.

Irrevocable Trusts: Less Control, Greater Protection

An irrevocable trust is just what it sounds like—once created, you generally cannot alter or dissolve it without the consent of the beneficiaries.

Pros:

- Removes assets from your taxable estate.

- Offers strong protection from creditors, lawsuits, and long-term care costs.

- Helps your estate avoid probate, just like a revocable trust.

Cons:

- You relinquish control over the assets in the trust.

- Cannot easily be changed once finalized.

Irrevocable Trusts Impact on Probate in NH:

Because the assets are no longer legally yours, they’re not subject to probate administration in New Hampshire. This makes irrevocable trusts especially valuable for clients looking to protect family wealth and streamline inheritance.

Which Trust Is Right for You?

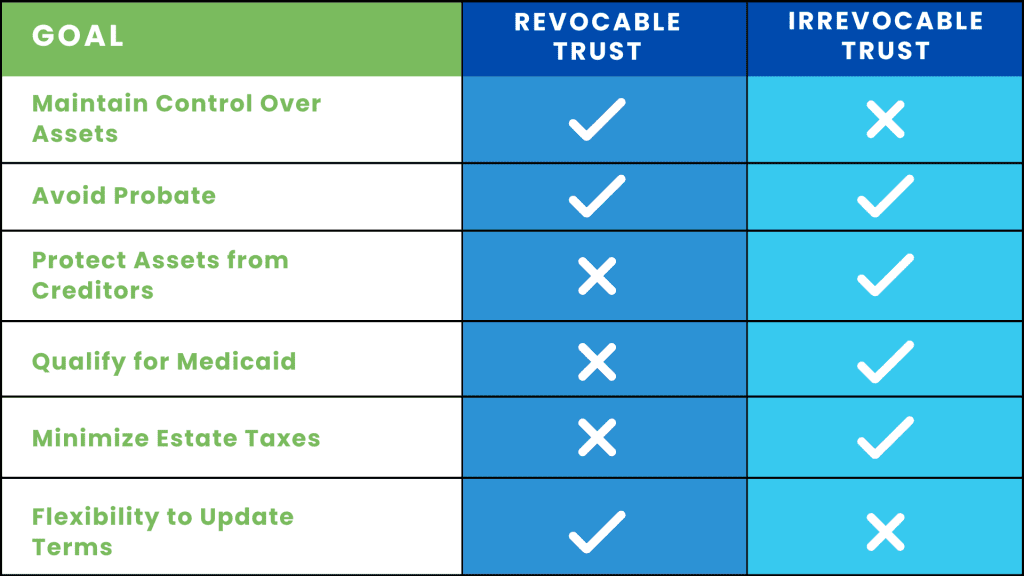

Choosing between a revocable and an irrevocable trust depends on your personal goals. Here’s a quick comparison:

Trust Planning in NH: Why Work with a Local Estate Attorney?

New Hampshire has its own set of estate laws and probate procedures, and what works in one state might not be effective here. At Beaupre Law, we specialize in trust planning in NH and provide custom solutions tailored to your needs—whether you’re starting your first trust or need help administering a loved one’s estate.

We walk you through every step, from choosing the right type of trust to making sure it’s properly funded—because even the best trust won’t avoid probate administration if assets aren’t titled correctly.

Ready to Take Control of Your Estate? Contact Beaupre Law Today!

If you’re ready to simplify your estate, avoid probate hassles, and protect your assets, let’s talk. Beaupre Law is here to make trust planning in NH straightforward and stress-free.